09 June 2012

Tata Chemicals Ltd Near term headwinds are adequately priced in, Upgrade to ‘Buy’ : Sunidhi

Tata Chemicals reported Q4FY12 results. Topline and EBIDTA numbers were in line with estimates. Sales at `34650 mn was up by 30%, while EBIDTA went up by 11% YoY. EBIDTA margin improved to 15.9% from last quarter’s low of 14.6%. Exceptional items include notional forex loss of `246.9 million, impairment of assets at `259.3 million.

CLICK links to Read MORE reports on:

sunidhi,

Tata Chemicals

Nifty could hit 5200-5300 in next two weeks: AK Prabhakar, Anand Rathi Securities

The broader market could test 5200-5300 over the next week or two if it manages to breach the strong resistance of 5120, technical analyst AK Prabhakar, Anand Rathi Securities, said.

"The falling trendline connecting the 5600 and 5300 highs is at 5120. If this is breached Nifty could test in the next week or two 5200 and then 5300 , which is the three-month high," he said, adding, "4950 was a strong support, which was the market's low over the past few sessions."

Nifty ended up two fifths of a percent at 5068.35 on Friday, its highest level since May 7 on hopes of an RBI interest rate cut at its policy meet on June 18 and likelihood of further stimulus measures by the US Federal Reserve to stave off a possible contagion from the euro area.

CLICK links to Read MORE reports on:

anand rathi

Personal Finance: Invest before interest rates falls further

Interest rates are coming down and expected to come down further in the coming days.

Prudent option is to choose quality companies immediately and invest in their FD schemes for a longer tenure.

With this in mind, we are presenting you with the select list of housing finance companies accepting deposits. Each one of them are consistent profit making and dividend paying company with a great track record.

CLICK links to Read MORE reports on:

fixed deposits,

Personal Finance

Oil < USD100 is a game changer for India : Motilal Oswal

Oil falling to USD100 levels

23% decline from recent peak of USD126

Major potential positives: CAD/GDP down

0.3-0.5%, fiscal deficit/GDP lower by 0.3%,

inflation down 40-97bp

Oil @ 100 equal to oil @ 80 in FY08

Oil < 100 a major game-changer for India:

positive spin-offs on growth, corporate

profits and valuation

CLICK links to Read MORE reports on:

Motilal oswal,

oil and gas

Nirmal Bang: “BUY” GMR Infrastructure - Target Price: Rs30

Losses Peak Out, Relief Ahead

GMR Infrastructure reported 4QFY12 net loss of Rs3.66bn (above our

estimate of a loss of Rs1.16bn and Bloomberg estimate of a loss of

Rs656mn) due to lower PLF in the energy segment, annual corporate cost

allocation to the airport segment, cost adjustment in the EPC segment and

exceptional items of Rs 1.16bn. We believe the losses have peaked out and

the revised tariff rates at Delhi airport (major reason for the losses in the

past) would improve its financial performance. However, poor performance

of the power segment due to shortage of gas and delay in the process of

monetisation of real estate at DIAL (Delhi International Airport) leads us to

trim our earnings estimate for FY13 and also the target price. We have

revised downwards our TP on the stock from Rs39 to Rs30 based on SOTP

valuation, but retained our Buy rating on it.

CLICK links to Read MORE reports on:

GMR,

nirmal bang

Power Grid -Increased capitalization to aid earnings, maintain ‘outperform’:: Sunidhi

Power Grid (PGCIL) reported its Q4FY12 numbers which were above our as well as street estimates. Revenue (`31 bn, 40.3% yoy), EBITDA (`26 bn, 44.1% yoy) and PAT (`10.3 bn, 37.4% yoy) all have seen robust growth, mainly driven by substantially higher capitalization for the quarter at `78 bn against `5.2 bn in Q4FY11 and `22.3 bn in Q3FY12. PGCIL surpassed its capitalization target for FY12, which stood at `141 bn against target of `120 bn and our estimate of `102 bn. We believe increased capitalization in FY12 would aid its earnings in FY13E-14E period as most of this capitalization are back-ended, given FY12 was the last year of 11th plan. We have revised our FY13E and FY14E EPS estimates upwards by 9.6% and 7.9% respectively to factor in increased capex and capitalization going forward. We maintain our ‘outperform’ rating on the stock with a revised DCF based target price of `123 (earlier `126/share), giving an upside potential of 16%.

CLICK links to Read MORE reports on:

power grid,

sunidhi

Two Wheeler Monthly Update: Ventura

Hero MotoCorp |CMP: `1,946|M.Cap:` 38,854 crore| Beating the slowdown!!! Outperforming its peers who posted a de – growth, Hero Moto Corp posted a 11.3% yoy growth in total volumes to 5,566,44 units. The company’s sales surpassed its previous highest of 5,51,557 units achieved in April’12. To maintain the growth trajectory the company is planning to add about 400 outlets to its existing 5,000-strong network in the current fiscal. The management is cautiously optimistic of that the expected normal monsoon and the consequent good harvest should perk up the sentiment in the coming months since it enjoys a strong market share in the rural areas. We recommend a BUY on the stock.

CLICK links to Read MORE reports on:

Auto

Educomp Solutions REDUCE -Cashflow still remains a concerns :ICICI Sec

Educomp Solutions’ (Educomp) Q4FY12 EBIT at Rs1.2bn and PAT at Rs0.6bn were

in line with our expectations, though lower than the management’s guidance which

was sharply cut a quarter ago. The management has guided for 25-30% revenue

growth in FY13 and EBITDA margin improvement of 150-250bps YoY. However, it

refrained from providing PAT guidance. We expect FY13 recurring PAT to be flat

YoY mainly due to expected surge in interest cost by 53% YoY owing to likely

refinancing of US$110mn FCCB maturing in July 2012 including premium which

was not getting charged off earlier. While the volume growth momentum in the

core business of Smart Class remains strong, pricing and hence margins are likely

to remain under pressure because of intense competition. Other businesses like K-

12 schools and supplemental education are in nascent stage and in investment

mode. Educomp is unlikely to turn FCF positive over the next two years. The stock

has corrected 40% since our downgrade last quarter and is down 70% YoY, and

with valuations at FY13E P/E of 8.6x and EV/E of 6x, we believe that the downside

is limited. Hence, we upgrade the stock to REDUCE from SELL with a revised

target price of Rs148 (6x average FY13-14E EV/E), however, it is still not the time to

accumulate the stock. Higher-than-expected Smart Class additions and any stake

sale of assets are the key risks to our negative stance.

CLICK links to Read MORE reports on:

EduComp,

ICICI Securities

Sectoral deployment of credit Growth moderation led by services and personal loan :Emkay

Non-food credit growth at 16.5% yoy; Service and personal loans report

credit growth at less than 2/3rd of previous period

Recent RBI data reveals that non-food credit growth has eased to 16.5% yoy for the

month of April-12 against 17% yoy for March-12 and 22.1% yoy in the corresponding

period of previous year. While credit to segments of agriculture (14.6% yoy) and

industries (19.5% yoy) remains healthy, major disappointment was witnessed in

exposure to segments of – a) services (15.8% yoy vs 24.1% yoy in Apr-11) and b)

personal loans (11.5% yoy vs 18.4% yoy in Apr-11). 13 of 23 sectors have reported

credit growth at less than 70% of growth for Apr-11 and is clearly reflective of growth

moderation due to elevated interest rate and uncertain business dynamics. Amongst

services segment – credit to CRE (6% yoy vs 22% yoy in Apr-11), NBFC (36% yoy vs

56% yoy in Apr-11) and other services (9% yoy vs 16% yoy in Apr-11) reported lower

growth. Personal loans was dragged by lower growth in sectors of – consumer durables

(-16% yoy) and housing loans (11% yoy). On the positive side : Growth was witnessed

in sectors of trade (19.1% yoy), wholesale trade (24% yoy), large ind. (22.4% yoy) and

secured asset class like vehicle loans (19.4% yoy) and education loans (14.5% yoy).

… sectoral credit composition still in favor of Industries

Growth moderation in credit to segments of services / personal loans as enabled the

share of industries to continue remain at high at 46% for Apr-12. However, a lower

PCFE and a muted growth in GCF as reflected in Q4FY12 GDP data suggest growth

moderation in coming periods.

CLICK links to Read MORE reports on:

Emkay

India Financials Bank Ahead – May 2012 :Prabhudas Lilladher,

Growth monitor (April 2012 sectoral trends): Overall loan growth continues to

moderate, with 16.5% YoY growth in non-food credit. Infra credit moderated

significantly with growth in power+roads portfolio down to ~18% (first <20% y/y

growth in the last five years). Ex-Infra Industrial credit surprised with 22%

growth largely driven by undefined other industries growing by ~47% YoY.

Services growth remained stable with wholesale trade/NBFCs aiding growth.

However, the biggest drag on services growth was fleet operator portfolio

growth moderating to 11% YoY growth. Retail credit continues to remain

sluggish with mortgages growth moderating to ~11%.

CLICK links to Read MORE reports on:

banks,

Prabhudas Lilladher

Sadbhav Engineering :: 4QFY2012 Result Update :: Angel Broking

For 4QFY2012, Sadbhav Engineering (SEL) reported a mixed set of numbers, with

revenue coming marginally higher than our estimates while earnings coming in

lower than our expectations. SEL had an order inflow of `2,844cr (majority

contribution by the two recent road BOT projects) during FY2012, taking its order

book to `7,554cr (2.8x FY2012 revenue), which provides good revenue visibility.

We maintain our Buy view on the stock.

CLICK links to Read MORE reports on:

Angel Broking,

Sadbhav Engineering

State Bank of India (SBI) :Tough times for subsidiaries:: Kotak Sec

State Bank of India (SBIN)

Banks/Financial Institutions

Tough times for subsidiaries. SBI’s banking subsidiaries’ FY2012 performance was

weak on most counts: (1) A sharp rise in slippages/restructuring resulting in higher

provisions, (2) a decline in NIMs and (3) subdued non-interest income. We expect

profitability to be weak over the medium term (RoE of about 15% and RoAs of 0.8-

0.9%) as we factor the regulatory impact of dynamic provisions. The contribution of the

subsidiaries remains low at 13% of the overall value. Maintain BUY.

How to book stock market losses and make money: Holistic Investment Planners

Booking losses at the right time forms the most important part of wealth management strategy.

Do you book profit or book loss?

You have bought the shares of ABC Ltd at a rate of Rs.100 per share. The current market price is Rs.150 per share. Also you have bought the shares of XYZ Ltd at a rate of Rs.200 and the current market price is Rs 125.

Do you book profits by selling ABC or book losses by selling XYZ.

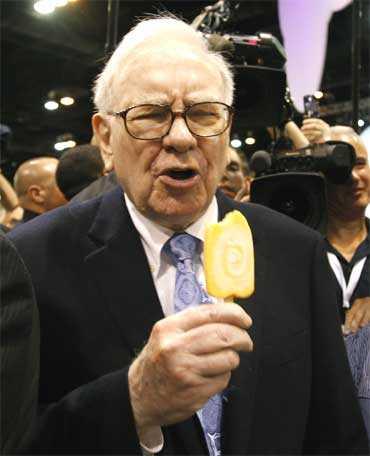

Rule No.1: Never lose money. Rule No.2: Never forget rule No.1: Warren Buffett

This quote from Warren Buffet is the essenceof selling loss-making investments as part of wealth management. However, to the contrary, most of us tend to sell those investments that make us money and prefer to hold on to those that are already making losses.

It is just probably a feeling that we could not have gone wrong and the investment would revive, or on the other hand a feeling that we have been fooled and do not want to be fooled again and do not want to take action.

CLICK links to Read MORE reports on:

Personal Finance

Want to become RICH? AVOID these 6 investing mistakes

The study of investors' behaviour offers some interesting mistakes you can recognise and avoid.

Finance professors aren't the first group of people you'd approach for investment advice. But if you end up in the same room with a couple of behavioural-finance economists, listen up.

They study the psychology and behaviours of investors to see where they make mistakes. If you learn to spot and correct these mistakes, it may mean greater profits.

Some insights behavioural finance has to offer read like common sense. It's no secret, for example, that many investors will focus obsessively on one investment that's losing money, even if the rest of their portfolio is in the black (profit). That's called loss aversion.

Other behaviours, though, are subtler, more difficult to spot, and harder to correct. Here are six such mistakes to avoid.

CLICK links to Read MORE reports on:

Personal Finance

Subscribe to:

Posts (Atom)